Navigating the Wholesale Market: The Importance of a Tax Identification Number

Related Articles: Navigating the Wholesale Market: The Importance of a Tax Identification Number

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Wholesale Market: The Importance of a Tax Identification Number. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Wholesale Market: The Importance of a Tax Identification Number

The wholesale market presents a unique opportunity for businesses to acquire goods at discounted prices, often in bulk quantities. This practice, known as wholesale purchasing, can offer significant cost savings and competitive advantages. However, navigating this market effectively requires a crucial element: a tax identification number (TIN).

Understanding the Role of a Tax Identification Number

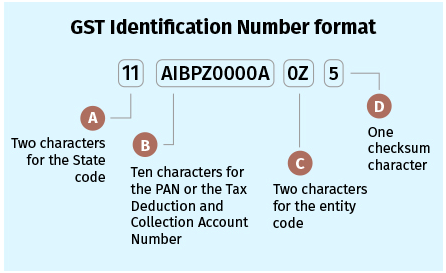

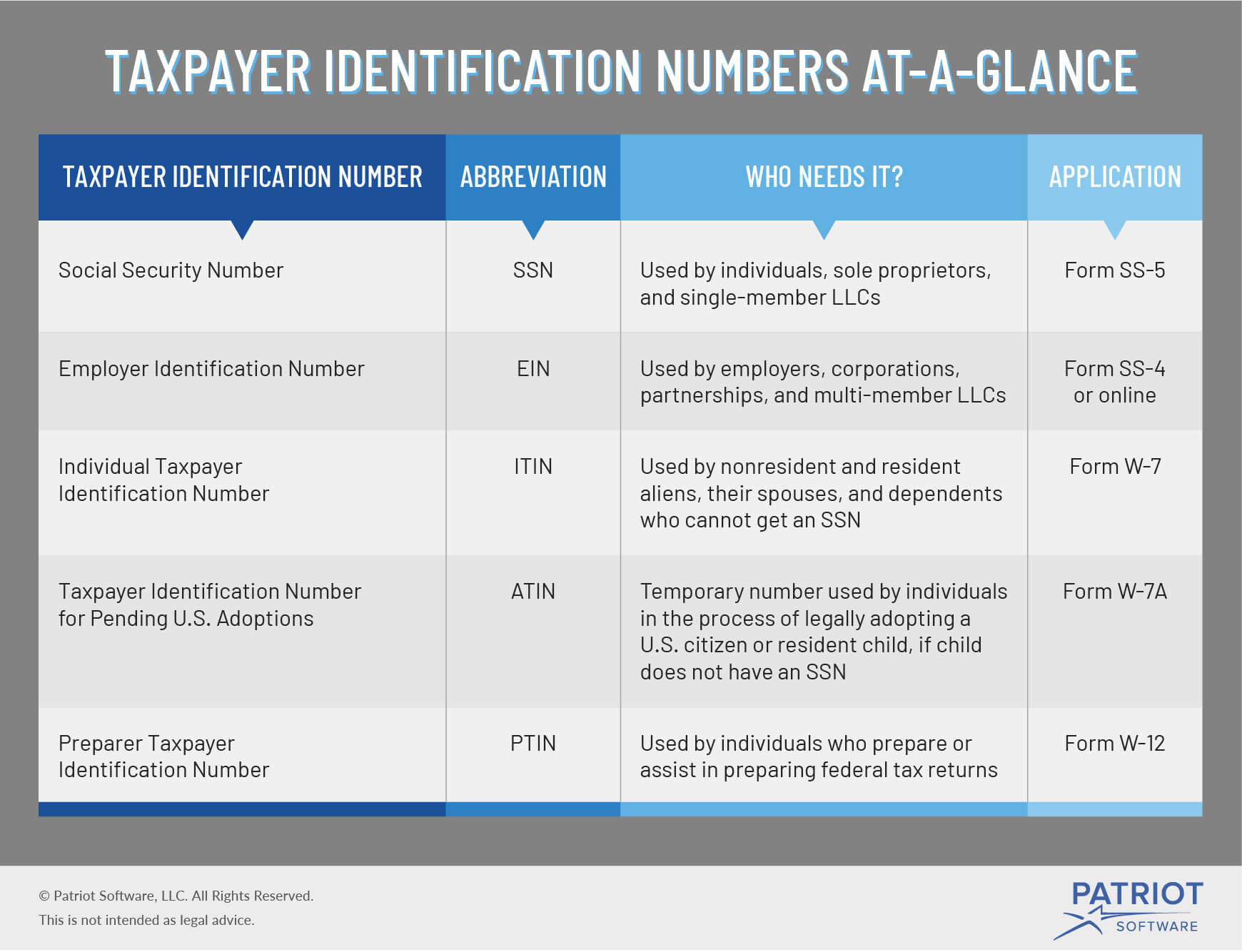

A tax identification number, often referred to as an EIN (Employer Identification Number) in the United States, serves as a unique identifier for businesses. It is assigned by the Internal Revenue Service (IRS) and is essential for various tax-related activities, including:

- Opening a Business Bank Account: Financial institutions typically require a TIN for businesses to open bank accounts.

- Filing Taxes: Businesses are obligated to file tax returns with the IRS, and a TIN is necessary to accurately report income and expenses.

- Applying for Business Licenses and Permits: Many states and municipalities require a TIN for businesses to obtain licenses and permits to operate legally.

- Engaging in Wholesale Transactions: This is where the significance of a TIN becomes particularly prominent.

Wholesale Purchasing and the Tax Identification Number

Wholesale suppliers often require their customers to provide a TIN for several reasons:

- Tax Compliance: Wholesale transactions often involve large sums of money, making it crucial for suppliers to ensure their customers are properly registered and compliant with tax regulations.

- Sales Tax Exemption: Businesses with a valid TIN may be eligible for sales tax exemptions on wholesale purchases. This exemption varies depending on state and local laws.

- Tracking Business Transactions: A TIN helps suppliers track business transactions, manage inventory, and maintain accurate records for accounting and tax purposes.

- Preventing Fraud: Providing a TIN serves as a form of identification, helping to prevent fraudulent activities and ensure the legitimacy of wholesale buyers.

Benefits of Purchasing Wholesale with a Tax Identification Number

Obtaining a TIN and utilizing it in wholesale transactions offers several advantages for businesses:

- Cost Savings: Wholesale purchases typically offer significant discounts compared to retail prices, allowing businesses to acquire goods at lower costs.

- Increased Profit Margins: Lower acquisition costs translate into higher profit margins, enhancing business profitability and competitiveness.

- Access to Exclusive Products and Deals: Wholesale suppliers often offer exclusive products and deals to businesses with valid TINs, providing access to unique inventory and market opportunities.

- Streamlined Business Operations: A TIN facilitates smoother transactions with suppliers, simplifies tax reporting, and streamlines overall business operations.

Navigating the Wholesale Market with a Tax Identification Number

Here are some key steps to effectively navigate the wholesale market using a TIN:

- Obtain a Tax Identification Number: Apply for an EIN through the IRS website or by contacting the IRS directly.

- Establish Business Credit: Building a strong business credit history can help secure favorable terms and discounts from wholesale suppliers.

- Research Wholesale Suppliers: Identify reputable and reliable wholesale suppliers that align with your business needs and offer competitive pricing.

- Negotiate Purchase Agreements: Clearly define the terms and conditions of wholesale purchases, including payment terms, shipping costs, and return policies.

- Maintain Accurate Records: Keep meticulous records of all wholesale transactions, including invoices, receipts, and payment details.

FAQs on Wholesale Purchasing with a Tax Identification Number

1. What if I am a sole proprietor or small business owner? Do I still need a TIN?

Yes, even sole proprietors and small business owners operating under their personal name are generally required to obtain a TIN for business purposes.

2. Can I purchase wholesale without a TIN?

It is highly unlikely that a reputable wholesale supplier will allow purchases without a valid TIN. This is due to tax compliance and fraud prevention measures.

3. How long does it take to obtain a TIN?

The application process for an EIN is typically completed online within a few minutes. However, it may take a few days for the IRS to process the application and issue the EIN.

4. What are the penalties for not having a TIN?

Failing to obtain a TIN when required can result in significant penalties, including fines and potential legal action.

5. Can I use my Social Security number as a TIN for my business?

While it is possible to use your Social Security number as a TIN for a small business, it is generally recommended to obtain a separate EIN to protect your personal information and for business tax purposes.

Tips for Success in Wholesale Purchasing

- Develop a Strong Business Plan: Outline your business goals, target market, and financial projections to guide your wholesale purchasing decisions.

- Establish a Budget: Determine a realistic budget for wholesale purchases to avoid overspending and maintain financial stability.

- Negotiate Discounts: Don’t hesitate to negotiate discounts with wholesale suppliers based on purchase volume, payment terms, or long-term relationships.

- Utilize Online Wholesale Marketplaces: Explore online platforms that connect businesses with wholesale suppliers, offering a wider selection and convenient ordering options.

- Maintain Positive Relationships with Suppliers: Build strong relationships with reputable suppliers through prompt payments, clear communication, and professional conduct.

Conclusion

A tax identification number is an indispensable tool for businesses operating in the wholesale market. It ensures tax compliance, facilitates streamlined transactions, and provides access to cost savings and unique opportunities. By understanding the importance of a TIN and following the steps outlined above, businesses can effectively navigate the wholesale market, optimize their purchasing strategies, and enhance their overall business success.

:max_bytes(150000):strip_icc()/tax-indentification-number-tin.asp-30a92e7158164a03921914a81532f9ab.jpg)

_%20(1).jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Wholesale Market: The Importance of a Tax Identification Number. We appreciate your attention to our article. See you in our next article!