Understanding Installment Plans: A Comprehensive Guide to Spreading Payments

Related Articles: Understanding Installment Plans: A Comprehensive Guide to Spreading Payments

Introduction

With great pleasure, we will explore the intriguing topic related to Understanding Installment Plans: A Comprehensive Guide to Spreading Payments. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding Installment Plans: A Comprehensive Guide to Spreading Payments

In the realm of consumer finance, installment plans have emerged as a popular and widely accepted method for acquiring goods and services. These plans allow individuals to spread the cost of a purchase over a predetermined period, making it more manageable and accessible. This article delves into the intricacies of installment plans, exploring their benefits, types, considerations, and potential drawbacks.

The Essence of Installment Plans

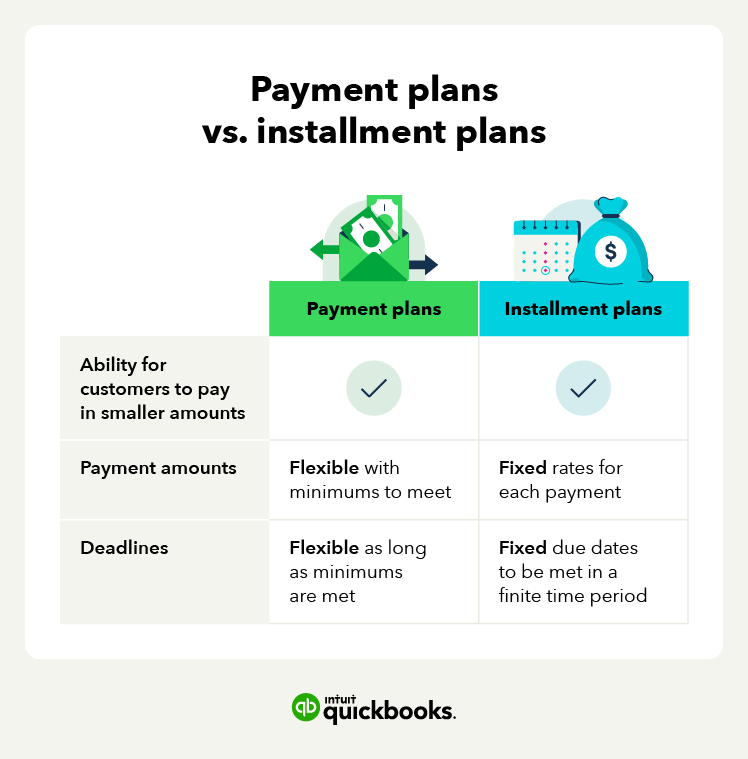

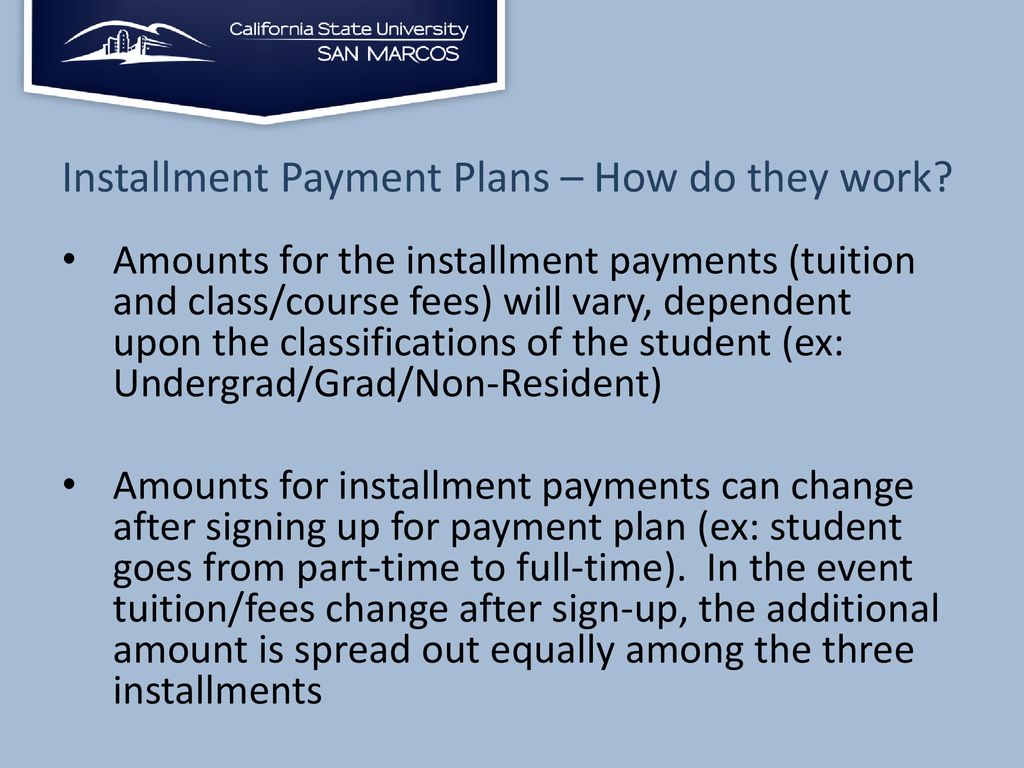

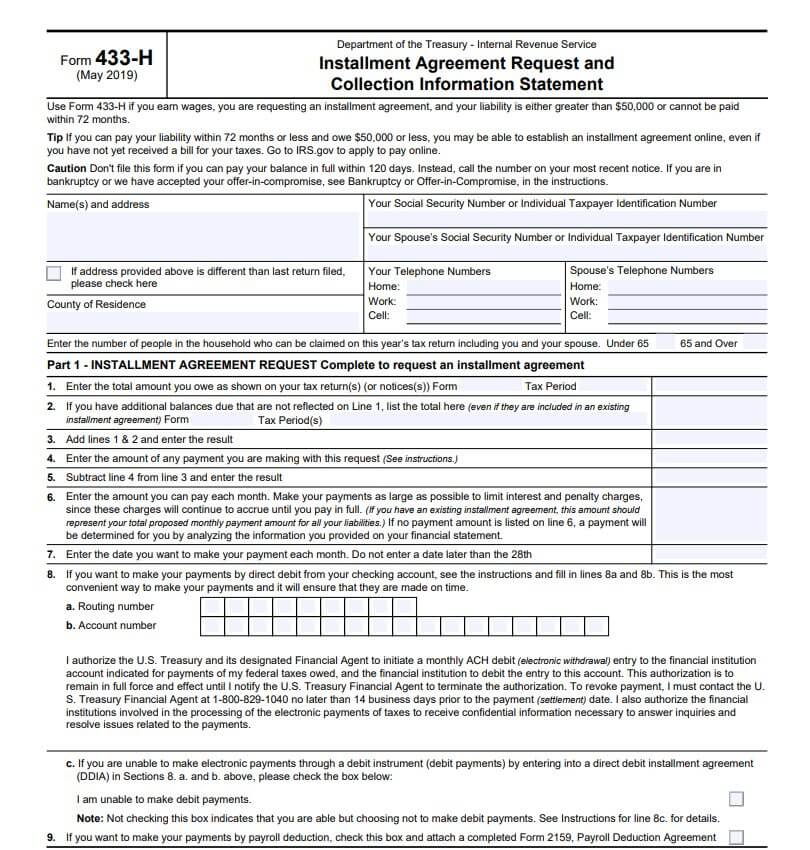

Installment plans are essentially credit agreements where a buyer agrees to pay for a purchase in regular, fixed installments over a specific timeframe. These plans typically involve a down payment, followed by a series of monthly or bi-weekly payments until the total purchase price is paid off. The interest rate, which reflects the cost of borrowing, is factored into the monthly payments, and the final amount paid often exceeds the original purchase price.

Benefits of Installment Plans

-

Accessibility: Installment plans enable individuals to acquire goods and services that they might otherwise be unable to afford outright. This is particularly beneficial for high-ticket items such as appliances, electronics, furniture, or even vehicles.

-

Budgeting: Spreading the cost over time allows for better budgeting and financial planning. By incorporating the fixed monthly payments into a budget, individuals can avoid large, unexpected financial burdens.

-

Improved Credit Score: Making timely payments on installment plans can demonstrate responsible credit management, potentially leading to an improved credit score. A higher credit score can open doors to better loan terms and lower interest rates in the future.

-

Deferred Payment: Installment plans provide a period of time before the full purchase price is due. This can be advantageous when unexpected expenses arise or when individuals need time to save up for a significant purchase.

Types of Installment Plans

-

Retail Installment Plans: Offered directly by retailers, these plans typically involve a set interest rate and a fixed payment schedule. They are often used for purchases of appliances, furniture, or electronics.

-

Bank Loans: Banks offer installment loans for a wide range of purposes, including car purchases, home renovations, and personal expenses. These loans typically have a longer repayment term and may involve higher interest rates compared to retail installment plans.

-

Credit Cards: While not strictly installment plans, credit cards can be used to finance purchases in a similar manner. Cardholders can choose to pay the full balance each month or make minimum payments, accumulating interest on the outstanding balance.

-

Rent-to-Own: This option allows individuals to rent an item with the option to purchase it after a set period. Payments made during the rental period are applied towards the purchase price. However, rent-to-own agreements often involve significantly higher total costs than purchasing outright.

Considerations and Potential Drawbacks

-

Interest Rates: Installment plans typically involve interest charges, which can add up over time. It is crucial to compare interest rates across different lenders and choose the option with the most favorable terms.

-

Fees: Some installment plans may involve additional fees, such as origination fees, late payment fees, or prepayment penalties. It is essential to understand all associated fees before committing to a plan.

-

Debt Accumulation: If payments are not made on time, the outstanding balance can accumulate, leading to higher interest charges and potential damage to credit scores.

-

Limited Access to Funds: Committing to installment plans can limit access to funds for other financial needs, as a portion of income is allocated to monthly payments.

FAQs Regarding Installment Plans

Q: What is the minimum down payment required for an installment plan?

A: The minimum down payment varies depending on the lender and the type of purchase. Some retailers may offer no down payment options, while others require a significant upfront payment.

Q: How long is the typical repayment period for an installment plan?

A: Repayment terms can range from a few months to several years, depending on the purchase amount and the lender.

Q: What happens if I miss a payment on an installment plan?

A: Late payments can result in late fees and potentially damage your credit score. It is essential to communicate with the lender if you anticipate difficulty making a payment.

Q: Can I pay off an installment plan early?

A: Most installment plans allow for early repayment, but some may involve prepayment penalties. It is advisable to check the terms of the agreement before making an early payment.

Tips for Utilizing Installment Plans Wisely

-

Shop Around: Compare interest rates, fees, and repayment terms from different lenders to secure the most advantageous offer.

-

Budget Carefully: Ensure that the monthly payments fit comfortably within your budget and do not strain your financial resources.

-

Make Timely Payments: Avoid late payments by setting reminders or using automatic payment options.

-

Consider Alternatives: Explore alternative financing options, such as personal loans or credit cards, to compare interest rates and terms.

-

Avoid Excessive Debt: Be cautious about accumulating too much debt through installment plans. Limit purchases to essential items and prioritize paying down existing debt.

Conclusion

Installment plans provide a valuable tool for individuals seeking to acquire goods and services over time. By understanding the benefits, types, considerations, and potential drawbacks of these plans, consumers can make informed decisions and utilize them responsibly. When used wisely, installment plans can facilitate financial planning, improve access to goods and services, and enhance credit scores. However, it is crucial to approach these plans with caution, carefully considering interest rates, fees, and the potential impact on overall financial stability.

.jpg?1677138400290)

Closure

Thus, we hope this article has provided valuable insights into Understanding Installment Plans: A Comprehensive Guide to Spreading Payments. We appreciate your attention to our article. See you in our next article!